Top 5 Silver Bullion Coins for Investment

From investment portfolios to collector's items, silver coins have always held a special allure. Their historical significance, intrinsic value, and stunning designs make them a favourite among investors and collectors alike. This article will delve into the five most sought-after silver bullion coins in the market today.

Is buying silver coins a good investment?

Silver coins present a compelling investment opportunity, offering several advantages over silver bars. While they command a higher premium over the spot price of silver due to costs associated with their design, minting, and collectible status, their smaller denominations enhance accessibility for smaller investors and facilitate ease of sale in modest quantities. Coins boast superior liquidity, particularly during market selloffs, as their global recognition simplifies the process of finding buyers compared to larger, potentially less recognised bars.

As legal tender, most silver coins garner additional trust thanks to the nominal value guaranteed by the issuing country, even though their metal content is often far more valuable. Moreover, coins minted by government entities are assured in weight and purity, bolstered by sovereign backing that enhances their investment appeal.

With intricate designs and advanced security features, coins are also more challenging to counterfeit than the simpler silver bars, offering investors a safer option. The collectability of coins, driven by factors like design, rarity, historical significance, or condition, can also lead to an appreciation that outstrips the increase in silver's value alone.

When it comes to storage and portability, coins are more convenient than large bars, fitting easily into home safes or safety deposit boxes. While silver coins provide numerous benefits, they may not suit every investor—those investing on a larger scale might find the lower premiums on silver bars more economically viable. Nevertheless, for collectors or smaller-scale investors, the merits of coins could surpass the cost of higher premiums.

Now let’s review the most popular silver coins in the world and why they're a MUST have in your portfolio!

1. The British Britannia 1 oz Silver Coin

The 1 oz Britannia Silver Coin was introduced by the Royal Mint in 1997, following the success of its gold counterpart launched in 1987. The coin's design is inspired by ancient Roman iconography and features Britannia, the female personification of Britain. The design of the coin is filled with symbolism. Britannia is depicted as a warrior queen, representing strength and integrity. She holds Poseidon's trident, symbolising Britain's maritime power, and a shield bearing the Union Jack, representing protection. Each year, the coin's mintage varies, affecting its rarity and value. Despite this, the 1 oz Britannia silver coin carries a relatively low premium, making it an affordable option for investors and collectors alike. The coin's high purity of .999 silver, its stunning design, and the Royal Mint's reputation all contribute to its popularity. Additionally, it is legal tender in the UK, which adds to its appeal.

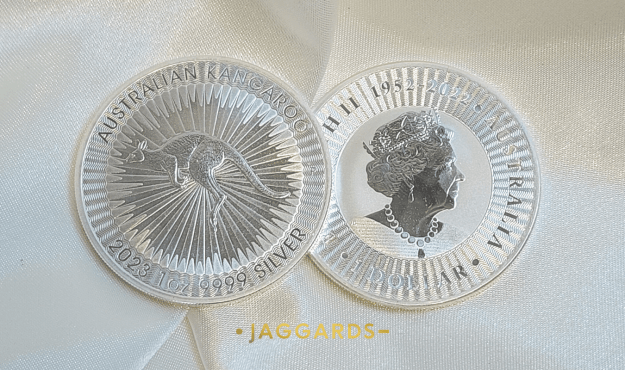

2. The Australian Kangaroo 1 oz Silver Coin

The Australian Kangaroo 1 oz Silver Coin, minted by the prestigious Perth Mint since 2016, is a popular option for investors seeking a reliable and affordable silver holding. This coin series features Australia's iconic kangaroo and boasts a consistent design with only the year date changing annually. Made from .9999 fine silver, its quality is backed by the Western Australian government, adding to its investment appeal.

Several factors contribute to the popularity of the Kangaroo coin. Firstly, it boasts a low premium compared to other silver coins thanks to its unlimited mintage based on demand and its Australian production, which reduces logistics costs for domestic buyers. Secondly, its government backing, and consistent design provide investors with a sense of security and stability. Finally, the coin's small price spread between buying and selling prices, typically around $6-$8, makes it a fast-moving option in the market, especially popular among Australian investors. With its combination of affordability, reliability, and consistent design, the Australian Kangaroo 1 oz Silver Coin stands as a solid choice for building a diverse investment portfolio.

3. The Canadian Maple Leaf 1 oz Silver Coin

Introduced in 1988 by the Royal Canadian Mint, the 1 oz Canadian Maple Leaf Silver Coin is renowned for its exceptional purity. Setting a new standard for silver bullion coins, it boasts a .9999 fine silver content.

Design-wise, the coin features the iconic Canadian maple leaf, meticulously crafted to represent national identity and values. This intricate detail showcases the mint's impressive artistry.

Mintage for the Maple Leaf varies annually, and its high silver content combined with the mint's reputation lead to a higher premium compared to other silver bullion coins.

Despite the premium, the coin's exceptional purity, beautiful design, and legal tender status in Canada solidify its popularity among investors worldwide.

4. The 1 oz Austrian Philharmonic Silver Coin

The 1 oz Austrian Philharmonic Silver Coin, minted by the Austrian Mint since 2008, offers a unique blend of investment potential and artistic appeal. This silver bullion coin pays homage to the world-renowned Vienna Philharmonic Orchestra, one of the most prestigious orchestras in history.

The coin's reverse side features a meticulously detailed image of various orchestral instruments, symbolising Austria's rich musical heritage. This intricate design embodies the spirit of the Vienna Philharmonic, offering a visual connection to their renowned performances.

Flipping the coin, you'll find the majestic Great Organ of the Vienna Musikverein's Golden Hall, the orchestra's home stage. This iconic image further connects the coin to the world of music and adds a touch of historical significance.

The Silver Philharmonic coin is minted on demand, meaning its production adjusts to market needs. This approach helps to maintain its value by preventing overproduction and potential market saturation. Furthermore, the coin carries a moderate premium compared to other silver bullion options, making it an attractive choice for investors seeking a balance between affordability and value.

Beyond its investment potential, the Silver Philharmonic's high silver purity of .999 and its status as legal tender in Austria add to its appeal. This combination of factors makes it a popular choice for collectors and investors alike, particularly those with an appreciation for music and Austrian culture.

5. The American Liberty 1 oz Silver Coin

The 1 oz American Liberty Silver Coin, or Silver Eagle as it's commonly known, isn't just a valuable piece of silver; it's a tangible embodiment of American history and ideals. Introduced in 1986 by the U.S. Mint, it has become a global phenomenon amongst silver enthusiasts and investors alike.

What Makes it a Top Pick?

The Silver Eagle's iconic design, .999 silver purity, and legal tender status in the U.S. make it a preferred choice for many investors.

While the .999 fine silver content holds undeniable value, the coin's true appeal lies deeper. Its design carries a powerful message, showcasing Lady Liberty on the obverse, a symbol of American freedom and democracy, forever striding towards a brighter future. The reverse features a heraldic eagle, a timeless image representing national strength and resilience. Owning a Silver Eagle becomes more than just an investment; it's owning a piece of American history and a symbol of the values the nation cherishes.

Despite a higher premium compared to some silver coins, the Silver Eagle's combination of historical significance, high silver content, and legal tender status in the U.S. makes it a sound investment. Its government backing by the trusted U.S. Mint adds an extra layer of security, making it a reliable and valuable addition to any investment portfolio.

What do all these silver coins have in common?

They boast high silver contents, iconic designs, and come from reputable producers. These qualities make them the most recognisable silver bullion coins globally, offering superior liquidity even in volatile market conditions. Investors value their certainty and security, despite potentially higher premiums compared to rounds or silver bars, as they provide peace of mind.

At Jaggards, we prioritise fair market pricing. Our cornerstone is the Australian Kangaroo coin, reflecting our alignment with market trends to ensure accessibility to our national icon. Our international coins maintain a consistent premium, typically a few dollars above the Kangaroo coin, enabling affordable diversification of your silver coin collection.

So, what's the world’s most popular Silver Bullion coin?

It's the 1oz Silver Liberty Coin, also known as the Silver Eagle. Its popularity commands higher premiums, making it a valuable addition to any collection. Keep an eye out for sales opportunities to acquire these coins, as they often offer a higher buyback rate as well.

When choosing the right silver coin for your portfolio, consider factors such as the coin's purity, design, mintage, and the reputation of the mint. The five coins discussed above are widely recognised and respected in the precious metal market, making them excellent choices for both new and seasoned investors.