At Jaggards, we pride ourselves on offering an exquisite collection of silver coins from the world’s leading mints, including the Perth Mint, Canadian Mint, Austrian Mint, US Mint, and the Royal Mint. Our selection features coins celebrated for their craftsmanship, design, and investment value, making them a prized addition to any collection or investment portfolio. Explore our range of silver coins and find the perfect piece that resonates with your passion for precious metals.

Silver coins offer a unique combination of investment potential, collectible value, and tangible ownership. Unlike stocks or bonds, you hold a beautiful physical object in your hand. Silver itself has a history of price appreciation over time, making it a smart addition to a diversified portfolio. But some silver coins hold even greater value due to their limited mintage, intricate designs, or special themes. This collectible aspect can make certain silver coins even more desirable in the future, potentially increasing their value beyond the spot price of silver itself. So, whether you’re looking to grow your wealth, add variety to your holdings, or own a piece of history, silver coins offer a compelling option for investors and collectors alike.

FAQs

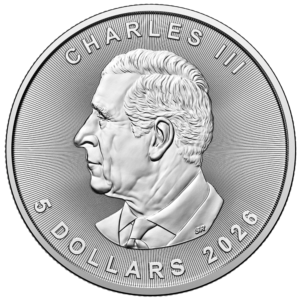

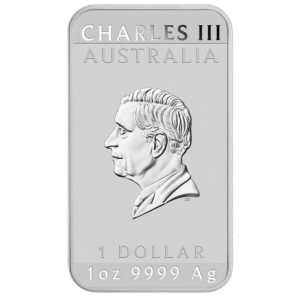

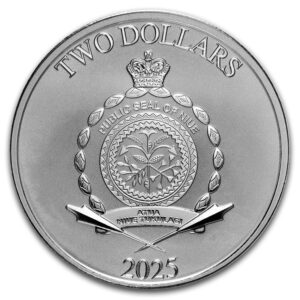

The most popular silver coins for investment include the American Silver Eagle, Canadian Silver Maple Leaf, Australian Silver Kangaroo, and the British Silver Britannia. These coins are highly sought after for their purity, legal tender status, and global recognition.

Before buying silver coins, decide if you’re prioritising investment or collecting. Investors should seek high-liquidity government-backed coins like American Silver Eagles or Perth Mint Kangaroos for easy buying and selling. Collectors can focus on unique designs, limited mintages, and historical themes, like the Perth Mint Lunar series. Look for factors like coin purity (.999 or .9999), mintage numbers (lower can be more valuable), and condition (important for collectors). Consider your budget and factor in the premium (extra cost above the spot price).

The price of a silver coins is determined by the current market price of silver (spot price) plus a premium (margin). The premium covers the costs of production, distribution, and a small dealer markup. Premiums can vary based on the coin type, quantity purchased, and demand. You can find the current silver spot price in AUD here.

In essence, the main differences between a silver coin and a silver round hinge on their legal tender status, collectibility, design, and the regulatory standards governing their production. Silver coins, being government-issued, often carry a higher premium and are sought after by both investors and collectors. Silver rounds, on the other hand, offer a more cost-effective way to invest in silver, focusing primarily on the metal content.