The secondary market bullion is defined as the buying and selling of precious metals to a party other than the original owner of that metal. The primary market, in contrast, refers to the purchase of new, uncirculated items. Understanding the gold spot price and silver spot price is crucial when dealing in the secondary market.

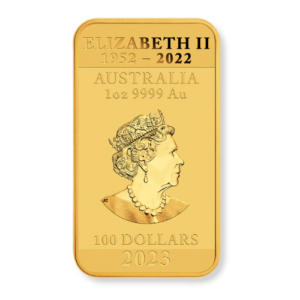

The secondary market bullion does not necessarily denote inferiority. In fact, gold bullion and silver bullion products can retain their market value in metal contents and, if produced in low mintage, can attract considerable value for their scarcity. This makes them an attractive option for those looking to sell gold or sell silver.

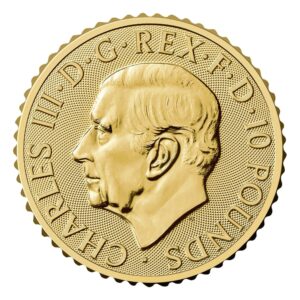

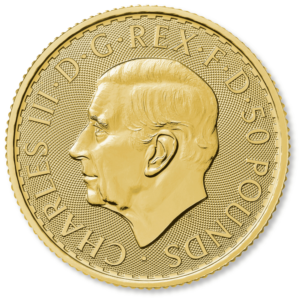

Jaggards, one of the leading bullion dealers, buys and sells items in the secondary precious metals market, in the form of bullion and numismatics. The products that Jaggards buys or sells are guaranteed for their authentication and metal value, and are appraised in accordance with the condition and circulation of the bullion product. Jaggards ensures competitive pricing based on current market values.

Secondary market bullion is in demand and has a firm place in the market because of several factors, these include:

- Acquiring bullion products in low circulation.

- Acquiring minted items from popular collections, including rare coins.

- Premiums are often lower due to signs of wear or circulation.

- Metals retain their intrinsic value, making them a popular option for smart investors as part of their investment strategy.

- Owning a secondary or rare coin with limited mintage can increase in value over time.

FAQs

Secondary market bullion refers to precious metal bullion that has been previously bought and sold. This can include gold bullion and silver bullion coins, bars, and rounds that have been circulated or have been purchased from a private seller.

There are several benefits to buying secondary market bullion, including:

- Lower premiums: Secondary market bullion often sells at a lower premium than new bullion. This is because the premium is typically based on the cost of manufacturing and distributing the bullion, which has already been incurred.

- Wider selection: The secondary bullion market offers a wider selection of bullion products than the primary market. This includes bullion from different mints, in different sizes, and from different eras, including rare coins.

- Investment potential: Secondary market bullion can be a good investment strategy, as it retains its intrinsic value and can appreciate in value over time, often tracking the gold spot price and silver spot price.

There are a few things you can do to buy secondary market bullion safely:

- Buy from reputable bullion dealers: Make sure to buy secondary market bullion from a reputable dealer who has a good track record. You can check online reviews and ask for recommendations from other investors. Jaggards has 60 years of experience in the bullion market, making us a trusted source for secondary gold and silver bullion.

- Get the bullion tested: If you are unsure about the authentication of the bullion, you can have it tested by a professional assayer. Jaggards performs a precious metal assay on all bullion before purchase to ensure its purity and authenticity. The technology we use includes Olympus GoldXpert XRF, a nondestructive precious metals assay.

Do your research! First and foremost, the best assurance you will receive is from dealing with reputable bullion dealers with a good track record in the market. Jaggards is backed by a 60-year legacy, and exceptional reviews testifying to the authentication of our products. Second, ensure your dealer has the tools and technology to authenticate bullion – we use XRF nondestructive assay technology to verify the purity of every secondary market bullion product.

Never purchase bullion from private sellers or third-party marketplaces such as eBay, Amazon, or Facebook Marketplace. These platforms offer little protection to buyers, and it can be difficult to verify the authentication of products purchased from these sources. Instead, rely on established bullion dealers like Jaggards for your secondary market bullion needs, whether you want to buy or sell gold and silver.