Charts

Live and Historical charts

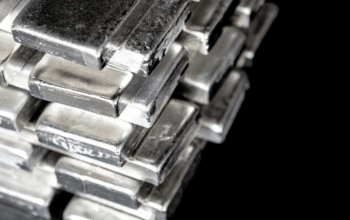

Live Silver & Gold Spot Price

Explore Charts And Prices

The Jaggards’ live spot price chart shows the real-time spot price for the four prominent investment metals: gold, silver, platinum and palladium. We also provide detailed information about change and change percents based on live spot data, as well as a decade of their historical data you can browse at your own leisure.

Select the tabs to navigate between the metals of your choosing to view individual live prices. You may also use the scroll bar or input custom dates to view fluctuations for any date range and metal.

Understanding gold and silver spot prices in AUD

Spot prices are the value of a specific asset if you bought or sold it immediately. The spot prices of precious metals (like gold and silver bullion) are generally based on one-ounce increments. Since spot prices are mostly uniform worldwide, you can quickly see how much an asset is worth in other countries.

Gold and silver spot prices are usually determined by a number of factors, including:

- Supply and demand

- Minute-by-minute speculation

- Purchasing and liquidation activity

The Australian gold and silver spot price is historically performant, which is why it remains a popular choice for many investors.

Using gold and silver spot prices to time the market

Both investors and collectors can use precious spot prices to make informed decisions about their next steps.

For example:

- Spot prices can be used to determine the immediate value of coins and bullion.

- Identifying low points in the market could indicate a purchase opportunity for precious metals.

- Identifying high points in the market could maximise your returns.

One of the most effective ways to track gold and silver spot prices is to rely on charts and live feeds. This allows you to monitor changes over daily, weekly or monthly increments. You may also be able to identify trends in the data that suggest changes to supply or demand, helping you to strategise the best possible time to buy or sell.

Jaggards makes it easy to accomplish spot price tracking effectively. Our chart allows for the selection of up to three index, commodity or currency options so you can view the percentage change over time for gold, silver, platinum or palladium. Browse our charts today to view metal spot prices in AUD at a glance.

How to track silver and gold prices in AUD with charts

Visit the Jaggards knowledge hub when you’re ready to learn more about metal bullion investing.

Make wise decisions with a silver and gold chart in AUD

Carefully tracking gold and silver spot prices in AUD is key to a timely purchase. By leveraging live and historical data to your advantage, you may be able to increase the payoff of your initial investment.

For more information about precious metal spot prices or to purchase gold and silver for yourself, reach out to the team at Jaggards today. We would be happy to help you take advantage of the bullion industry and collect precious metals for your investing needs.

Market Insights – Gold & Silver Price Performance

FAQ

Not necessarily. Spot prices are reflections of how much you could make if you sold your gold or silver bullion immediately. However, the buyer in question might offer more or less depending on the quality and rarity of the coin. You’re welcome to bring your bullion to Jaggards’ Sydney showroom to get a personalized price.

Like many other investments on the Australian market, it’s a good idea to buy low and sell high to maximise your returns. You can use our spot price chart to make more informed decisions by identifying highs and lows in the marketplace. If you’re newer to precious metals and want more information about bars and bullion, you can refer to our glossary at any time.

Generally speaking, yes. While country conversion rates do have some impact on spot prices, the value of precious metals is universally ubiquitous. Many investors appreciate the worldwide value of metal bars and bullion, especially as a hedge against inflation and global unrest.