Gold Performance Q1 2023 Gold Gains 11.2% in Q1 2023 Despite Volatility

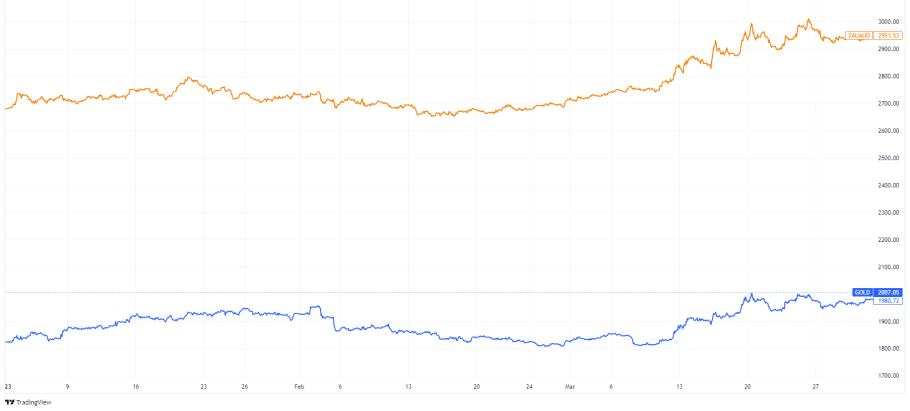

The first quarter of 2023 has been a strong period for gold, with the precious metal gaining 9% to reach $1,980/oz in USD $ terms and $2980 in AUD $ terms gaining 11.2% year to date. However, the performance has not been without volatility, as gold has been swayed by bond market volatility and simmering geopolitical tensions. Despite not being able to sustain momentum above US$2,000/oz, gold’s resilience has continued. In this article, we will delve deeper into the Q1 performance of precious metals, particularly gold.

March 2023 Precious Metals Review

Gold: Gold prices started the month at $2717.03 AUD, reached a high of $2980.56 AUD, and ended at $2944.84.

Silver: At the beginning of the month, silver was valued at $31.03 AUD. It experienced a temporary decline on March 8th, hitting a low point of $30.39 AUD. However, the remainder of the month witnessed a robust surge in silver prices, with the metal ending the month at $36.04 AUD.

Platinum: Platinum began the month on a low note, starting at $1418.24 AUD. However, it experienced a significant increase, spiking to $1503.02 AUD on March 13th. Although it later experienced a slight dip, platinum still finished the month on a positive note at $1487 AUD.

Source: TradingView

Gold’s Performance in Q1 2023

The Gold Market Commentary report notes that gold’s quarterly average price rose to $1,890/oz ($2780/oz in AUD terms), just 1% below its record high seen in Q3 2020. Gold has been able to find support from lower yields, with yields on US 10-year Treasuries falling by 40 basis points in the quarter. This decline has been the biggest driver of gold’s performance, as it has boosted the precious metal’s returns.

Furthermore, the report highlights the unexplained component of the Gold Returns Attribution Model (GRAM), which has been positive in each of the first three months. This component may partly represent the continued strength in central bank demand for gold. The rule of thumb from the Qaurum model states that it takes about 30 tonnes of gold demand to move the price by 1%, suggesting a figure of around 140t gold, which is close to what central banks have already reported.

When we look at gold’s performance across major currencies in Q1, it’s clear that it was a solid quarter for the metal. Across USD, EUR, JPY, GBP, CAD, CHF, INR, RMB, TRY, and AUD, gold saw gains ranging from 5.4% to 10.2%.

| USD (oz) | EUR (oz) | JPY (g) | GBP (oz) | CAD (oz) | CHF (oz) | INR (10g) | RMB (g) | TRY (oz) | AUD (oz) | |

| 31 March 2023 price | 1,980 | 1,826 | 8,456 | 1,605 | 2,676 | 1,812 | 52,308 | 437 | 37,971 | 2,961 |

| March return | 8.50% | 5.90% | 5.90% | 5.70% | 7.50% | 5.40% | 7.90% | 7.50% | 10.20% | 9.20% |

| YTD Return | 9.10% | 7.80% | 10.60% | 6.90% | 8.80% | 8.10% | 8.40% | 8.80% | 11.90% | 11.20% |

Source: World Gold Council

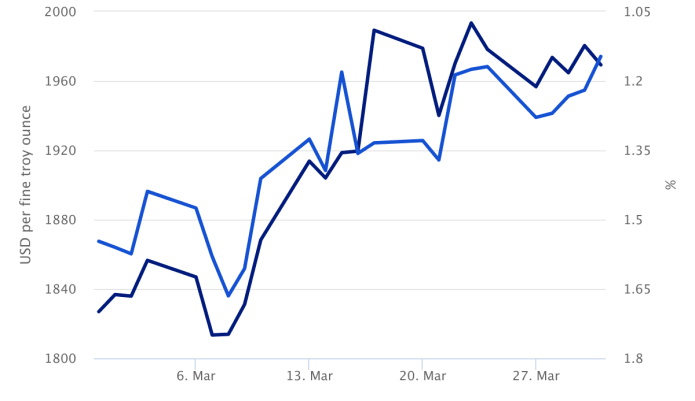

Gold Price and Real Bond Yields

Real yields reached their highest level since November of last year before eventually dropping to 1.1% at the end of the month. Why did this happen? Investors grew more pessimistic about the US economy, particularly due to concerns surrounding the banking sector. This caused the overnight index swap (OIS) curve to reflect the weakening sentiment.

Initially, the market was expecting a further 75 basis points of rate hikes following the March meeting. However, by the end of the month, there was uncertainty as to whether there would even be one more hike. Furthermore, it was anticipated that there would be two rate cuts by the end of 2023. This could have significant implications for the US economy and its investors.

Another interesting development to note is the lower-than-expected PCE inflation for February. This is the Fed’s preferred measure of inflation, and it was actually beneficial for gold. Why? Because it supports the idea that US inflation is decreasing, giving the Fed more room to pause or even cut the Fed funds rate. Even consumer expectations of inflation have decreased in the latest reading, although the USD 5y5y inflation swap has remained stable between 2.5-2.6%.

Source: Bloomberg

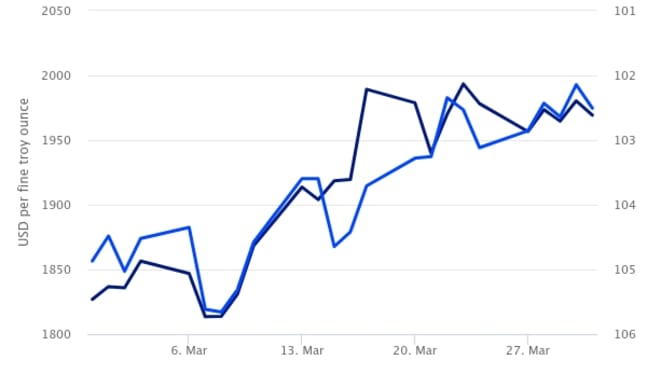

Gold price and the US Dollar

In March, the USD index fell by 2.3%, with gold emerging as a beneficiary due to a rise in demand for perceived safe-haven assets. However, concerns centred in the US, coupled with lower real yields, limited the USD’s gains. The softer USD also boosted gold’s performance throughout the month.

Central banks globally experienced a significant shift in policy rates, with the US witnessing the most dramatic repricing. The peak rate for the US is expected to be reached in May, if not already achieved. On the other hand, the Eurozone had its peak rate forecasts reduced by 75 basis points, while the UK remained relatively unaffected. The Sterling was the strongest major currency against the USD in Q1, with gold continuing to outperform even the British pound.

Source: Bloomberg

Geopolitical Developments

Another factor that has been driving the demand for gold in Q1 2023 is the uncertainty surrounding the global economic recovery. While the global economy has been showing signs of recovery from the pandemic-induced slowdown, there are concerns that the recovery may not be sustainable, and that there may be further disruptions to the economy. This has led many investors to seek out safe-haven assets like gold as a way to protect their portfolios from potential economic volatility.

In addition to these factors, there have also been several geopolitical developments that have contributed to the demand for gold in Q1 2023. One of the most significant of these has been the ongoing tensions between the United States and China, which have been fueled by a range of issues, including trade, technology, and human rights. As these tensions have escalated, investors have become increasingly concerned about the potential impact on the global economy and have turned to gold as a way to hedge their portfolios against any negative outcomes.

Looking forward

While gold’s performance in Q1 2023 was impressive, it is important to look ahead and see what the future holds for the precious metal. As mentioned earlier, the risk of an economic crisis is growing, and this could be a major driver for gold in the coming months.

The unprecedented rate hikes that have started to impact small US banks and the commercial real estate sector are just the tip of the iceberg. If the crisis deepens and spreads to other sectors, we could see a significant increase in demand for gold as investors seek out safe havens.

Additionally, with a US recession still on the cards, growing systemic risk adds to gold’s case. The US economy has been on a strong growth trajectory for several years, but there are concerns that this growth may be unsustainable. A recession could be triggered by a number of factors, including a significant rise in interest rates, a global economic slowdown, or a geopolitical crisis.

In any of these scenarios, gold is likely to be a beneficiary as investors seek out safe havens to protect their wealth. This is because gold has traditionally been seen as a store of value that retains its worth even in times of crisis.

Disclaimer

Please note that past performance does not guarantee future results. This news and any links provided are for general information only and should not be taken as constituting professional advice from Jaggards.

Jaggards is not a financial adviser. We recommend you seek independent financial advice before making any financial decisions based on the information contained in this article.