The Beginner’s Investing Guide: Part 2 – How much precious metal should you invest in?

Part 1 – Why invest in precious metals > Part 2 – How much precious metal should you invest in? > Part 3 – When is the best time to buy gold? > Part 4 – Choosing the right investment option

Part One of our Beginner’s Guide to Precious Metals explained why gold, silver and other metals are an excellent addition to an investment portfolio and discussed some of the most commonly asked questions about investing in gold and silver. If you missed it, you can review it here.

This article dives into the often-asked question of how much precious metal to buy. While there is no hard and fast answer, the following are some expert recommendations when it comes to the percentage of your portfolio made up of precious metals, the split of gold and silver, and how much money you should spend on these assets.

What percentage of my portfolio should be precious metal?

In some circles, the ‘10 per cent rule’ recommends that no more than 10 per cent of any investor’s portfolio should be held in precious metals. Other experts suggest you can have up to 15 or even 20 per cent of your portfolio allocated to this investment.

Both recommendations reflect the best practice of not putting all your eggs in one basket and assuming you will also invest in assets such as cash, stocks, government bonds, real estate, private business etc.

When it comes to percentages, your final figure may be influenced by your preferences and your goals. When you make a decision, you and your financial planner/investment advisor will probably be thinking about:

- How important liquid assets are to you

- How much income do you want to derive from your investments

- Your appetite for risk

- Other assets you plan to invest in

- Current economic conditions and the benefits of precious metals over other investments at this point in time

- The way global currencies are performing in the market

Gold, silver and the risk-to-return ratio

As explained in Part One of our Guide to Precious Metal, precious metals are regarded by many as the ultimate safe haven for investors because they deliver steady growth potential and give investors the opportunity to diversify.

In the uncertain times we are currently experiencing, investing in gold, silver and other metals is one of the safest ways to protect your investments against inflation and currency devaluation. This is because global share prices and economic conditions are highly volatile right now. An individual may decide to expand the precious metal portion of their portfolio to a higher percentage in order to protect their wealth and minimise the risk of financial loss.

If you decide to invest in precious metals as a way to avoid high-risk investments and a volatile share market, you will also need to consider which metals you invest in. For the purpose of this article, we will focus on gold and silver, which can be very different performers.

A 70% gold and 30% silver ratio is widely recommended. Let’s take a quick look at both:

Silver

The average volatility of silver is almost double that of gold. Silver trades in a range of circa 31% in a given year, whereas gold’s annual volatility averages 15.8%.

As shared by CPM Group, silver rises more than gold in bull markets and falls more in bear markets. Silver’s higher volatility can mean more opportunities for short-term focused investors who have a higher appetite for risk.

Recently, Oxford Economics recommended that investors would benefit from an average of 4-6 per cent overall silver allocation within their portfolio. This is because of silver’s sensitivity to trends in the production cycle. Having greater potential for rises and falls means it has a worthy place in a diverse investment portfolio.

Gold

Dollar for dollar, gold is worth more than silver and it does not tarnish the way silver does. Because you will get less gold for your money than silver, you will need less room to store it.

More than any other investment, gold is relied on to hedge against inflation and currency instability. When prices rise, the value of money drops. Meanwhile, every currency has the potential to fall in comparison to its counterparts.

When other commodities fall, investors tend to turn to gold, which helps to increase its value. The same applies when the cost of living goes up. This is why gold is often described as a ‘crisis commodity’ — when the value of property or stocks plummet, gold is much more likely to do the opposite.

How much precious metal to buy in terms of value

The decision about how much you wish to spend on your precious metals investment will also impact the percentage it takes up in your portfolio.

Buying precious metals needs to be worth it. Unlike savings or shares, precious metals need a place to ‘live’. Secure vaulting is one of the best solutions for precious metals but it does come with a cost. This is something to factor in when purchasing gold, silver, platinum or palladium. You don’t want to have so small an amount that your gains are offset by the holding costs.

There is insurance to think of as well. Because precious metals are physical assets, they will need to be insured, which will add to the price of your investment.

To help minimise these costs for investors, Jaggards offers an exclusive vaulting facility that is fully insured. This complete offering makes the journey to purchase and hold bullion less complex and more cost-effective. View our secure storage solutions or contact us to find out more.

The other thing to consider is the fees you pay for your purchase. Premiums tend to be higher on partial-ounce purchases of precious metals. This can hold back your returns so you may prefer to invest in a more significant amount of precious metal for this reason.

Add precious metals and create a diverse portfolio

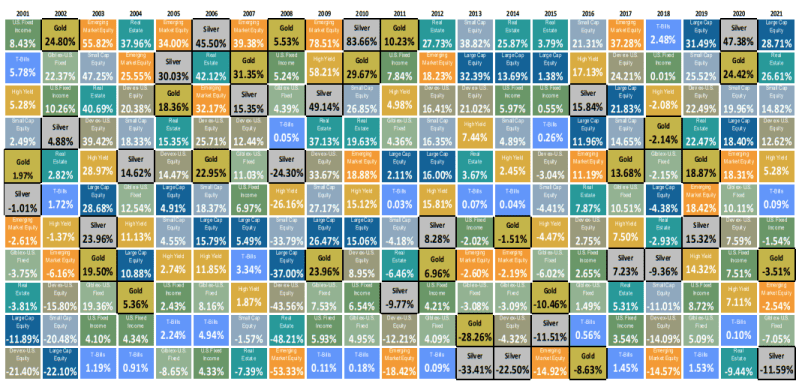

A recent CNBC article explained the importance of having a balanced portfolio. It shared a chart with the top-performing investments over a ten-year period. Only three asset classes were in the top position more than once. As the article explained, it’s nearly impossible to pick and choose which assets will outperform its counterparts each year. However, if you had invested across every asset class equally, your returns would have been significantly higher than if you missed the top three each year.

Source: CPM Group

This basic example shows why at least some of your portfolio should include precious metals. Work with your financial planner/investment advisor to figure out what is the right amount for you and what your spending should be.

Looking to purchase precious metals? Connect with us now

Rest assured that you are in good hands. The Jaggards team has been assisting clients in safeguarding their wealth and retirement portfolios through precious metals for over 60 years. Take the first step towards securing your financial future by contacting us today. Speak with our knowledgeable professionals via phone – 02 9230 0886 or email us at [email protected]

Disclaimer

Please note that past performance does not guarantee future results. This article and the links provided are for general information only and should not be taken as constituting professional advice from Jaggards.

Jaggards is not a financial adviser. We recommend you seek independent financial advice before making any financial decisions based on the information contained in this article.