The Beginner’s Investing Guide: Part 1 – Why invest in precious metals?

Part 1 – Why invest in precious metals > Part 2 – How much precious metal should you invest in? > Part 3 – When is the best time to buy gold? > Part 4 – Choosing the right investment option

When people think of investing, their minds often go to shares and property. However, recent stock market fluctuations and volatility across the property market have investors considering alternative strategies.

Purchasing precious metals is one option that has outstanding potential to deliver solid returns. If you’re not familiar with the benefits of this strategy, our comprehensive guide to precious metals will explain almost everything you need to know.

In this article, we take a look at why smart investors choose precious metals and share some helpful answers to common questions.

Why buy precious metals? All your questions answered

These are the main reasons why we recommend every investor includes precious metals in their strategy:

#1 For certainty and security

Precious metals are regarded by many as the ultimate safe haven for investors because they deliver excellent growth potential as well as the ability to diversify.

In uncertain times, this strategy is one of the safest ways to protect your investments against inflation and currency devaluation.

#2 The results speak for themselves

Owning physical gold or silver helps you diversify your portfolio and protects your wealth from inflation. Buying physical silver and gold also gives you peace of mind as you will know your savings are safe from devaluation.

The evidence of this comes from the numbers. Gold and silver prices have risen steadily since the financial crisis of 2008. This is mainly because of economic uncertainty. While other investments fluctuate or rise rapidly and then crash (hello cryptocurrency), precious metals tend to deliver steady returns.

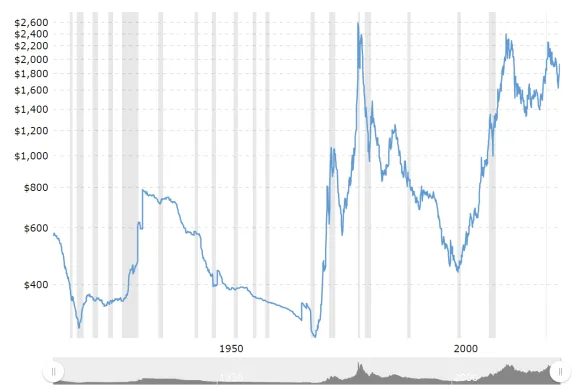

Going by the numbers, gold has performed better than the S&P 500 over various time horizons.

In 1971, the dollar’s value in gold was separated from its price. Gold’s price increased from US$35 to an average closing price of $1,802.39 over the next 51 years.

This works out to an annualised rate of return of 107.6%.

From its low point of 98 in 1971, the S&P 500 has risen steadily to its present value of 4456, representing a yearly return of 89.2%.

Image Source: macrotrends.net

#3 Trading in precious metals is relatively easy.

The beauty of precious metals is that you don’t need special investor status or specialist knowledge to invest. Gold, silver, and other precious metals are simple, straightforward, and globally accepted as a medium of exchange.

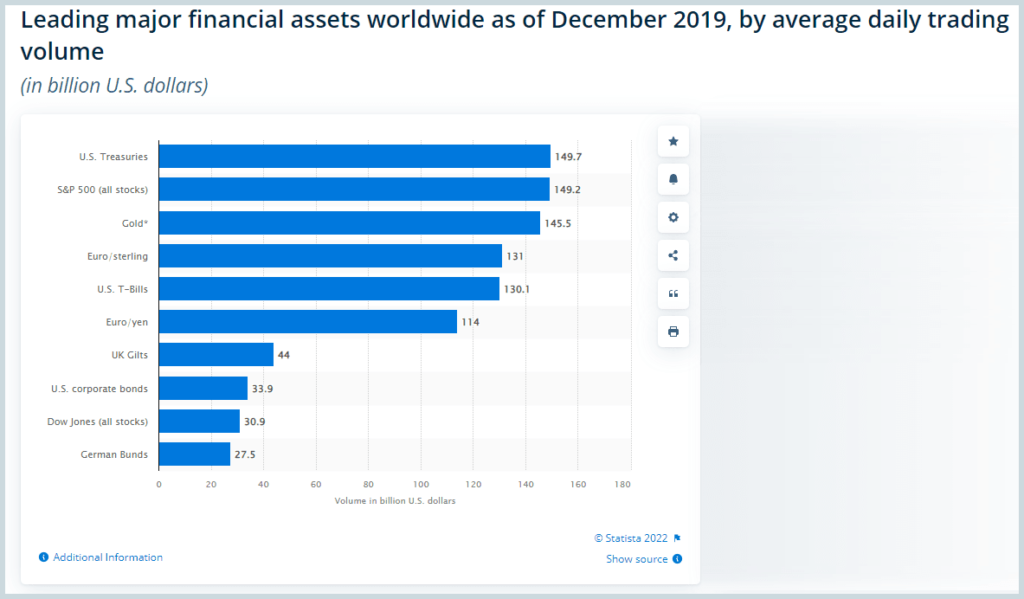

This makes them very liquid and easy to trade — after US Treasuries and the S&P 500 index, gold is the third largest daily trade made across the world.

Gold and silver bullion are the obvious choices because they are easy to buy and sell, and are accepted widely — with a reliable price structure that is accessible anywhere, anytime.

Rarer precious metals like palladium and platinum are also available as investment-grade bullion and are useful for diversifying your portfolio. However, they are not so easy to trade because the market for them is far smaller.

#4 Precious metals can be sourced locally.

According to The Perth Mint, Australia holds around 17% of the world’s gold resources and accounts for 9% of global production. Western Australia alone produces almost 68% of Australia’s gold.

Mining ethically in a politically stable country means you can relax about your precious metals extraction polluting the environment or adding to global climate change.

The Perth Mint is highly regarded across the world for the purity and reliability of its metals refining and processes.

Image Source: statista.com

#5 You get instant access to a tangible asset

The biggest advantage of precious metals is undoubtedly the ability to have instant access to them. Your gold, silver, or other precious metal is something that exists in the real world, rather than less tangible stocks or non-fungible tokens.

Precious metals of all types guarantee long-term financial security. What’s more, unlike currency or exchange-traded funds, because you possess the physical metal, they can never be a source of total financial loss that way shares can be.

Unlike an asset such as property, if you do decide to sell your precious metal, doing so should be easy and fast, and you can sell as much or as little as you like at a time.

#6 Precious metals act as a long-term hedge against inflation.

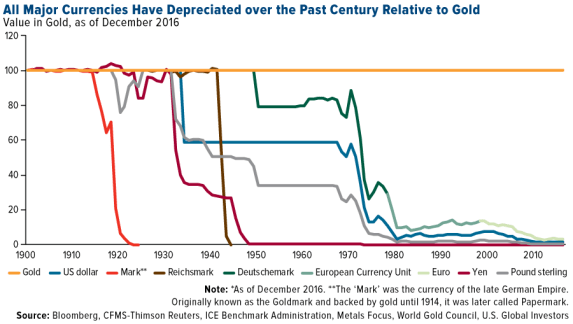

The value of money has declined but the value of gold has increased relative to other currencies.

What has actually happened is that the currencies have lost their value, but gold still has a tangible worth. The same idea applies to silver, platinum, and palladium. Take a look at the loaf of bread example further on in this article, which explains how gold holds its value in more detail.

#7 Lower risk

The rise and fall of the value of shares and assets such as crypto-currency can be rapid and unpredictable. Precious metal is seen as a far more constant and reliable investment.

Precious metals FAQ

If you’re just getting started investing in precious metals, the following information will help to inform your decisions.

Who can invest in precious metals?

Easily the biggest misconception about precious metals is that they are only for “the rich”. Massive vaults full of gold bars and secretive Swiss bank accounts come to mind but the truth is plenty of ‘everyday’ Australians include precious metals in their investment strategy.

Because of the privacy of precious metals holdings, it is difficult to be precise about the number of people who invest in gold, silver, platinum or palladium, but it is estimated that between 3% and 9% of the Australian population own some type of precious metal for investment.

The Jaggards team has dealt with precious metals since 1963. Our customers come from every background you can imagine — we have caretakers, nurses, teachers, pilots, surgeons, and millionaire business owners (and everyone in between) among our clients.

They hold precious metals for many reasons — but by far the most popular is as an “insurance policy” against financial risk.

How can precious metals be owned?

- Precious metals can be owned as:

- Mining stocks – holding shares in mining companies

- ETFs – where you buy your metals on paper and hold them remotely

- Derivatives

- In physical metals such as bars or coins of bullion.

Although investing in such physical precious metals isn’t necessary, some investors choose to do so because it provides them with tangible benefits.

When you invest in metal bars or coins, you have the real metal in your possession (or safely tucked away in a vault or safe location).

Which precious metals should I buy?

Precious metals investors hold gold bullion and silver bullion, but some investors also have platinum and palladium in bullion form. You can make a decision based on your preferences, your budget, and the help of a specialist precious metals advisor.

Read more: How much precious metal should I invest in?

What makes gold and silver a go-to investment?

For as long as mankind has existed, gold and silver have been a store of wealth and a safe investment haven through wars, famines, natural disasters, mass migrations, and economic turmoil for millions of people.

Every civilisation has used gold — think Tutankhamun or the Aztecs. Australia still has around 60,000 abandoned gold mines scattered across its territories.

What is so incredible about gold is that it stands alone, now, after the demise of thousands of human monetary systems. History is littered with currencies that failed. Recent examples include Venezuela, Zimbabwe, Iceland, and Russia but gold and silver coinage is a constant.

The reason is financial resilience.

It’s a tough concept to get your head around, but let’s take the example of a loaf of bread.

Imagine buying your loaf in 1900.

Research tells us that loaf would have cost you around 10 cents, back then. This same loaf today would cost you about $3.53.*

Now imagine you paid for that loaf with gold rather than dollars.

Gold was worth $20.67 an ounce in 1900 so the bread would have cost .004837th of an ounce of gold.

The gold price today is around $1,700 – so .004837th of an ounce would be worth $8.29 ($12.23 AUD)

If you bought that same loaf today, with that same amount of gold, you would get $4.76 change IN your pocket – instead of being $2.60 OUT OF pocket.

This is the effect of inflation. That difference of $7.36 is why major economies keep gold reserves.

*Because Australia has only had a national currency since 1910, it makes comparison difficult. These examples use the US dollar to illustrate the effects of inflation – but the principle remains the same.

Where should I keep my precious metals?

Storing precious metals under the floorboards is not the ideal solution — nor is it a spot of midnight gardening.

If you want to store precious metals at home, we can advise on the ideal floor safe, secure vaults, and guarded transportation for domestic storage of your gold or silver.

Because of the risk of theft, after you buy precious metals, you should consider keeping them in a secure storage location. Make sure you have good insurance coverage and assay/authenticity certificates. Do your research to confirm you are paying reasonable storage fees — this will help you maximise your long-term returns.

Storage options (and related tips) include:

- Safe deposit boxes and consumer banks. These are popular with our clients for smaller quantities of precious metals holdings and investment-grade bullion.

- Bullion bank vaults or bullion depositories for precious metals storage. This storage solution can help to minimise insurance costs, especially if you have a larger quantity of gold or silver.

- Secure vaulting facilities are the first choice of professional bullion investors for larger amounts of physical gold bullion. These are a logical choice for your own gold bullion and silver bullion storage because there is a high level of security. Jaggards is able to offer clients the use of our private vault for a low cost, with insurance included. View our secure precious metal storage options or contact us to find out more.

Remember, because of the price differential, silver will take far more storage space than the same monetary value of a single gold bar.

Image: To scale, a visual representation of the volume of a $5,000 investment of gold vs silver.

At Jaggards, we use offsite gold storage services and offer a choice of vault locations. These offer the best safety and flexibility against different levels of risk. Contact us to find out more.

There are pros and cons to the storage method alternatives, and you need expert advice from a trusted dealer on the best solution for your needs. This is where Jaggards’ reputation and experience are invaluable.

How can I use precious metals to protect my wealth?

The Australian debt clock is a fascinating introduction to why gold matters in the big picture.

This ‘clock’ displays exactly how much money is owed by the Australian Government, households, and individuals in Australia. It’s a staggering amount.

The Aussie dollar is printed when the government needs to “borrow” money for things like their pandemic stimulus programme’s JobKeeper payments and HomeBuilder grants.

They then add the amounts of money created to the national debt. Like any debt, this needs to be repaid.

In the meantime, interest is added to this debt.

This all creates inflation and makes the value of each dollar worth less over time.

Precious metals side-step inflation by being a “physical lump of value” which is exchanged for a currency, like the Aussie dollar.

The metal is always the same, whether it’s a thousand years old or cast yesterday. Its value is constant — it’s what it’s exchanged for that varies.

This is why precious metals give you a far more independent alternative to the “normal” financial investments out there.

The problem is the world’s stock markets no longer accurately reflect economic health.

Guaranteed bailouts and stimulus packages will continue to drive up stock prices artificially.

This will inflate away currency problems, with stock prices measured in the devalued currency.

Interest rates on bonds will rise if inflation is not contained and if investors sell government bonds because of low returns, compared to inflation, both of which would foreshadow a large crash in the stock market and the housing market, which is supported by debt from the bond market.

The current “official” rate of Australian inflation is 6.1%, and forecast to go even higher over the next twelve months.

Because of the size of the national debt, the Reserve Bank of Australia is limited in how far it can push interest rates to stop this cycle of monetary destruction.

With precious metals largely immune to the inflation cycle, they make sense as an investment now more than ever.

In Part Two of our Guide to Precious Metals, we look at the sweet spots for the number of precious metals to include in your portfolio.

Looking to purchase precious metals? Connect with us now

Rest assured that you are in good hands. The Jaggards team has been assisting clients in safeguarding their wealth and retirement portfolios through precious metals for over 60 years. Take the first step towards securing your financial future by contacting us today. Speak with our knowledgeable professionals via phone – 02 9230 0886 or email us at [email protected]

Disclaimer

Please note that past performance does not guarantee future results. This article and the links provided are for general information only and should not be taken as constituting professional advice from Jaggards.

Jaggards is not a financial adviser. We recommend you seek independent financial advice before making any financial decisions based on the information contained in this article.