In today’s volatile economic landscape, safeguarding your wealth through tangible assets has become increasingly essential. Gold, with its enduring value throughout millennia, continues to stand as a beacon of financial security. By choosing LBMA accredited gold through Jaggards bullion, you are not only investing in a valuable metal but also in peace of mind, knowing that your investment meets the highest gold purity standards. This commitment to excellence is what sets Jaggards apart, making us the preferred choice for investors seeking to secure their wealth with gold of the utmost quality.

Secure Investment: Gold is globally recognised for its intrinsic value and resilience against economic downturns. By incorporating 1oz gold investment into your portfolio, you’re choosing a secure and tangible asset that acts as a protective hedge against inflation. Unlike paper currencies which can be devalued through excessive printing, gold maintains its purchasing power over time, making it an excellent store of value during periods of currency debasement or economic uncertainty.

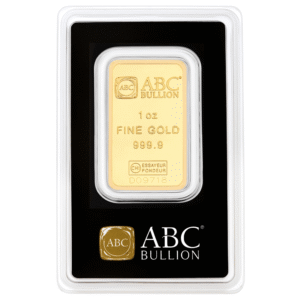

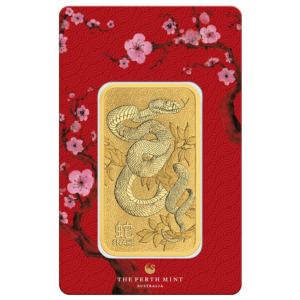

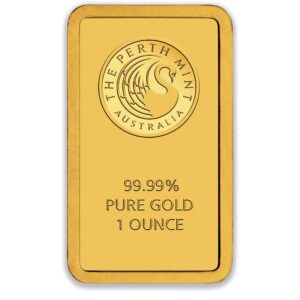

Convenient Size: The 1oz gold bars are highly sought after due to their convenient gold bar weight, making them easy to store, transport, and trade. Whether you’re a seasoned investor or new to the world of precious metals, these gold bars offer a straightforward way to own physical gold. The standard dimensions and weight ensure liquidity in the market, allowing for efficient buying and selling when the need arises. This accessibility makes 1oz bars an ideal entry point for investors beginning their precious metals journey.

Reputable Sources: At Jaggards, we pride ourselves on providing our clients with gold bullion from the most reputable mints and refiners. Our selection of 1oz gold bars is guaranteed for their gold purity and authenticity, ensuring you invest with confidence. Each bar comes with proper assay certification and unique serial numbers, providing you with irrefutable proof of authenticity. We maintain direct relationships with prestigious refineries, eliminating middlemen and ensuring competitive pricing for our valued clients.

Build a Diversified Portfolio: Gold is an essential component of a diversified investment portfolio. Its historical performance in times of economic instability makes it an attractive option for investors looking to mitigate risk and protect their wealth. Understanding current gold market trends can help you make informed decisions about your investments. Financial advisors typically recommend allocating between 5-15% of an investment portfolio to precious metals, creating a balanced approach that can weather various economic conditions.

FAQs

One-ounce gold bars are the most popular weight option among our clients. This is because they require a lower upfront cost compared to larger bars. Additionally, this weight option provides a better price break compared to smaller bars, which come with higher gold bar premiums (the cost of gold above the spot price of gold). This weight is the perfect choice for investors who want to enter the market with relatively lower upfront costs. It is also highly liquid, making it easy to sell or trade.

The price of a 1oz gold bar fluctuates based on the current gold spot price. At Jaggards, we offer competitive gold bar prices to ensure you get the best value for your investment. Our gold trading platforms provide real-time updates on gold prices, allowing you to make informed decisions.

Selling your gold and silver bullion is a quick and easy process

Get a Quote

Get in touch by phone, via our live buyback rates online or visit our showroom. Buy back prices will be finalised once the bullion has been received and tested

Get your metals to us

Visit our Sydney showroom or post your metals to us. Precious metals presented for sale will be authenticated using proprietary non-invasive assaying methods

Receive Payment

Once we receive your metals, our team will inspect each item and approve the sale. After approval, your payment will be issued.

Yes, gold is considered an excellent investment during inflation. As a physical asset with intrinsic value, gold typically maintains or increases its purchasing power when paper currencies lose value. Historical data shows that gold prices often rise during periods of high inflation, making it an effective hedge to protect your wealth against rising prices.

While timing the gold market perfectly is challenging, many investors follow a dollar-cost averaging approach – purchasing at regular intervals regardless of price. Historically favourable buying opportunities often occur during periods of stock market strength when gold prices may be subdued. The best strategy is typically to maintain a consistent allocation to gold (5-15% of your portfolio) as a long-term wealth preservation tool rather than attempting to time short-term price movements.