Another Australian Rate Rise and US Looking To Raise Again as Well

Yesterday, the Reserve Bank of Australia (RBA) surprised many by announcing an increase in the base interest rate by 0.25% to 3.85%, despite predictions to the contrary. This follows a series of previous increases, resulting in heightened financial strain on Australian households due to rising mortgage rates and the cost of goods and services.

In a similar vein, the Federal Reserve (FED) in the United States is expected to announce an increase in its baseline rates to 5.25% tomorrow. Although some economists are hopeful that the cumulative impact of more than 500 basis points of rate hikes in the past 12 months may be sufficient to curb inflation, the anticipation of tomorrow’s announcement has already caused a 1.2% decline in the US500.

Adding to the economic pressures faced by the US, discussions surrounding the national debt ceiling are ongoing, and the earning season has been subdued. These factors, in combination with the forthcoming interest rate increase, are creating an environment of significant strain on the US economy.

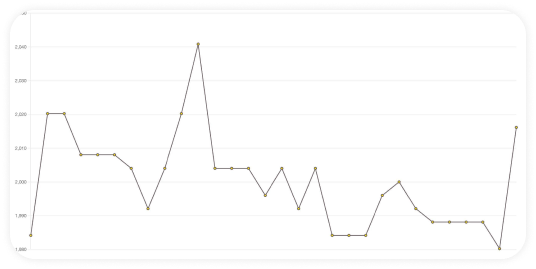

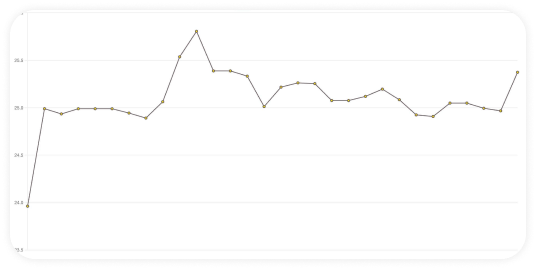

As expected, the above announcements led to a jump in both gold and silver prices in the last 24 hours. The exodus from the share market into precious metals continues.

*Not financial advice, please do your own research prior to any investment decisions you make.

30 days of gold pricing (USD)

30 days of silver pricing (USD)

Vitae suscipit potenti senectus penatibus id. Porta urna lacus pellentesque ultricies non dapibus. Tortor turpis nunc feugiat praesent. Tincidunt aliquam sagittis nunc mattis molestie id quisque posuere. Lectus quam volutpat ullamcorper tristique.

Nisl risus vestibulum ac tincidunt nibh in eget laoreet. Duis habitant tempus in praesent sollicitudin in neque integer donec. Euismod dictum tortor imperdiet nibh amet ac. Euismod tortor risus augue arcu. Congue interdum enim et in malesuada nunc risus sem. Eget sit viverra volutpat amet. Ipsum amet libero dictumst laoreet neque. Rhoncus pellentesque diam mattis nunc diam ultrices morbi. Lacus suscipit non risus sodales feugiat.

Magnis senectus etiam eu nisl. Sit varius nunc faucibus enim egestas massa aenean. Montes in blandit euismod viverra. Ipsum sed fringilla metus facilisi. Dui pharetra cursus et mattis ut donec cursus amet. Integer ipsum aenean est tristique ut habitant. Ut consequat ac nisl etiam. Ac aliquet sed tellus netus et eu enim. Orci lectus viverra fermentum lectus malesuada tincidunt egestas nisi. Diam volutpat eget luctus mi consectetur massa iaculis. Eu senectus massa tellus mauris.

Aenean bibendum hac mi nisi metus tristique. At amet nulla lectus velit proin neque sed volutpat. Eget quis auctor ultricies ultrices fames ut aliquam at. A nunc sed ultrices ut pellentesque at. Nulla adipiscing enim nisl bibendum. Commodo consequat at ornare interdum sed. Libero dictumst sed nec senectus aliquet tellus nullam. Sed integer eros libero volutpat urna adipiscing nulla ornare. Enim odio nisi nisl lectus convallis arcu ut etiam.