PPI increases putting extra pressure on Inflation

FED reporting has just put PPI (Producers price index) squarely in front of the blame for persistent inflation stress. As wholesalers and producers in the US reported a jump from 0.3% to 0.6% for the month of February, CPI data next month can expect to jump upwards again as well. PPI generally has a flow on effect for CPI (wholesale increases, putting pressure on retail to also increase).

And again, we remind everyone that late last year the FED hinted at 3 interest rate cuts this year. Presently, we see little to no reason to cut rates at all. Employment is strong and Wall Street is even stronger. For those desperately hanging in there for promised interest rate cuts, it might be better to focus on something else. At best, we’re estimating 1 rate cut, late this year.

Another devastating piece of information hidden within CPI is ‘the cost of shelter. This past year rent, houses and hotels have increased in pricing 5.7%. While 2023 peaked at 8.2%, current rates of shelter increase are still wildly above the norm and are putting huge pressure on tenants worldwide.

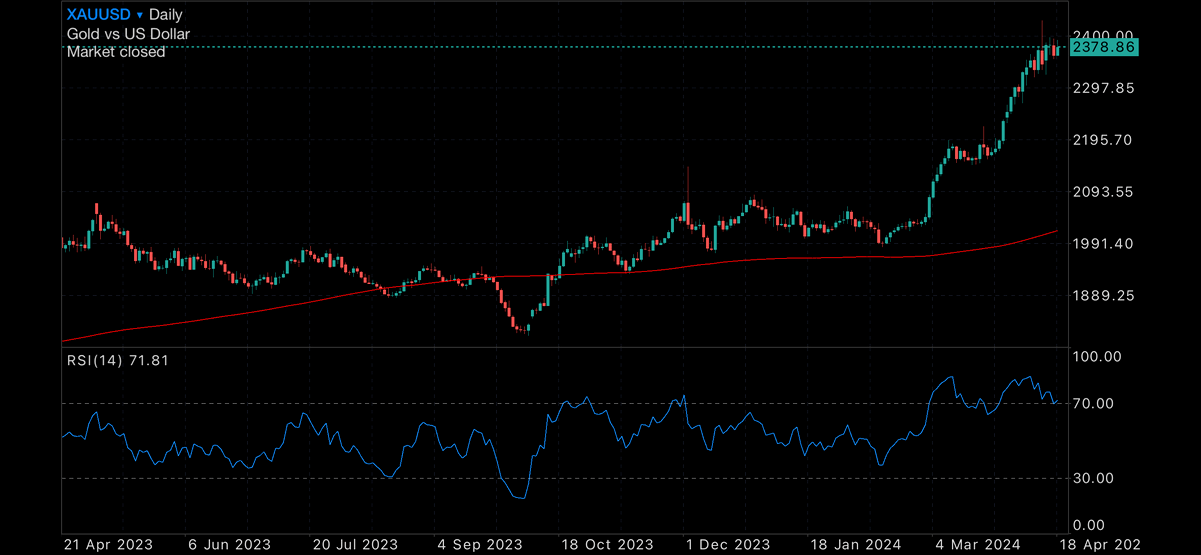

Meanwhile, Gold continues to climb.

Enjoy today’s charts and forecast.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

ASX200, with 200MDA

Gold Futures Technical Analysis

Gold Futures monthly analysis continues to recommend a STRONG BUY with Weekly analysis a STRONG BUY signal.

Technical indicators – Monthly Projections

| RSI(14) | Buy |

| STOCH(9,6) | Buy |

| STOCHRSI(14) | Overbought |

| MACD(12,26) | Buy |

| ADX(14) | Buy |

| Williams %R | Overbought |

| CCI(14) | Buy |

| ATR(14) | Less Volatility |

| Highs/Lows(14) | Buy |

| Ultimate Oscillator | Buy |

| ROC | Buy |

| Bull/Bear Power(13) | Buy |

Summary for Monthly Forecast: Strong Buy

*Not financial advice, please DYOR prior to any investment decisions you make.