Gold and Silver Retreat, but Economic Uncertainty Remains

Spot pricing for Gold $AU6355

Spot pricing for Silver $AU75.05

Spot pricing for Platinum $AU2392

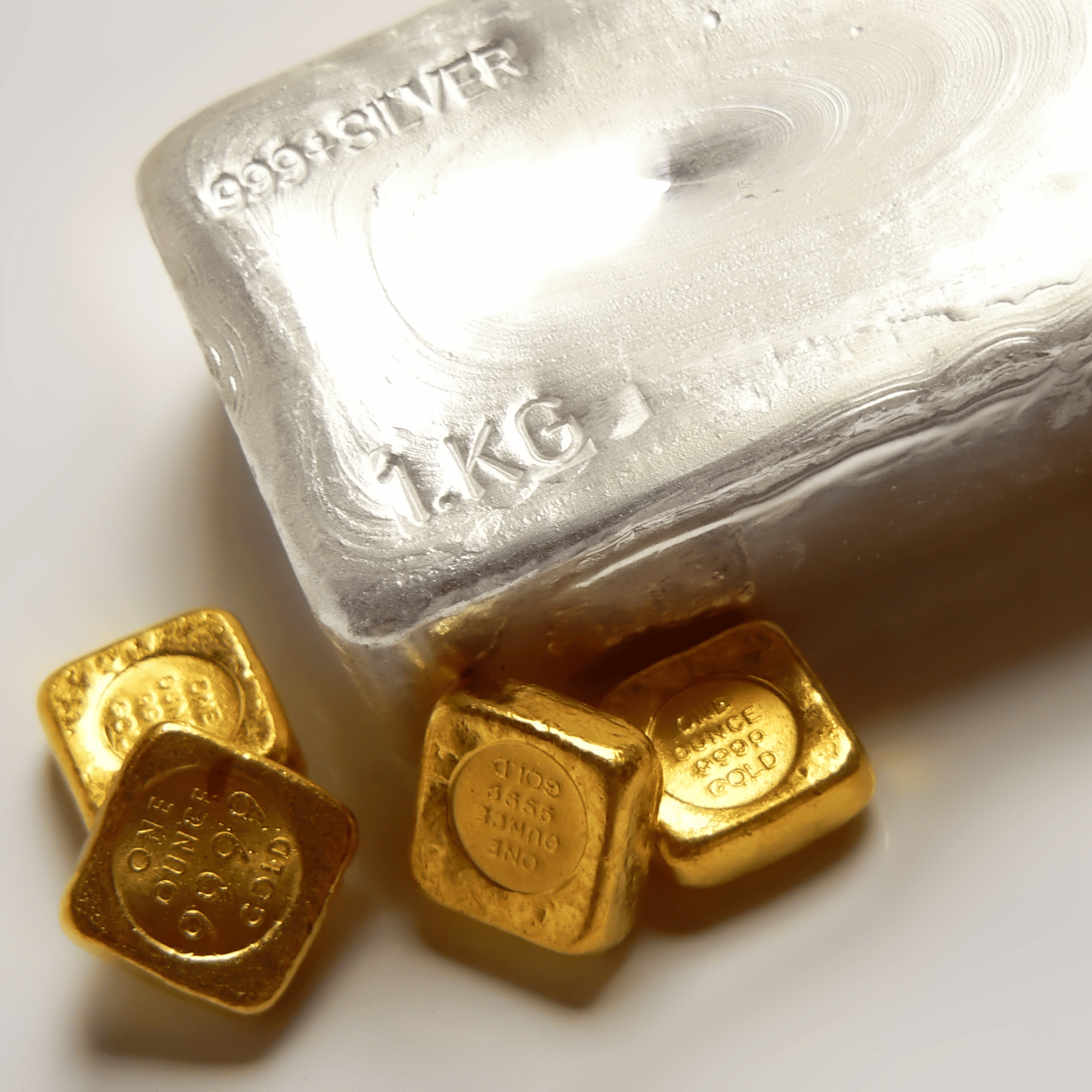

Gold and silver prices have finally paused for breath after an extraordinary run, retreating sharply overnight as traders took profits from heavily overbought levels. Gold recorded one of its largest 12-hour pullbacks in recent history, while silver followed suit, though both metals remain significantly higher than last month’s averages.

Despite the short-term correction, physical demand remains intense. Dealers across Australia continue to report long queues of buyers eager to secure bullion as confidence in broader economic stability wanes. Many investors appear to view this dip as a buying opportunity rather than a turning point.

Attention now turns to the United States, where a packed week of economic data could set the tone for global markets. The upcoming CPI print, leading economic indicators, and jobless claims will all be closely watched for clues on whether the Federal Reserve’s tightening cycle is finally having its intended effect—or if inflationary pressures remain too sticky to ignore.

For now, bullion markets are catching their breath. But with uncertainty spreading through equities and currencies alike, few believe this week’s volatility will be the last we see.

Thanks for reading – and always do your own research before making any investment decisions.

Enjoy today’s charts.

Gold daily chart, with 50MDA

Silver daily chart, with 50MDA

US500, with 50MDA

ASX200, with 50MDA