Markets React to RBA Cut and Powell’s Inflation Pivot

AUD Spot Price Gold

$AU5130

AUD Spot Price Silver

$AU51.71

AUD Spot Price Platinum

$AU1660

The Reserve Bank of Australia surprised markets this week by cutting the cash rate, easing it by 25 basis points in a move that puts the official rate at 3.85%. The decision comes amid signs of softening domestic demand and subdued wage growth, giving the RBA confidence to shift gears slightly from its prolonged pause.

In the US, Federal Reserve Chair Jerome Powell delivered remarks that reignited the inflation-first narrative, firmly stating that interest rate cuts will not come at the expense of price stability. His tone was a pivot from recent dovish sentiment and seemed to underscore that the battle against inflation is not over. Australian policymakers may take note, especially if inflation surprises to the upside in coming months.

Gold surged more than 2% in the past 24 hours, snapping back from last week’s dip as global investors recalibrated around the dovish RBA and Powell’s renewed inflation focus. The yellow metal is now trading at $AUD5132, driven by safe-haven demand and speculation that further monetary policy divergence may be on the horizon.

Markets will now be watching closely for any signal that the RBA’s rate cut is a one-off adjustment or the start of a new easing cycle.

Enjoy today’s charts.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

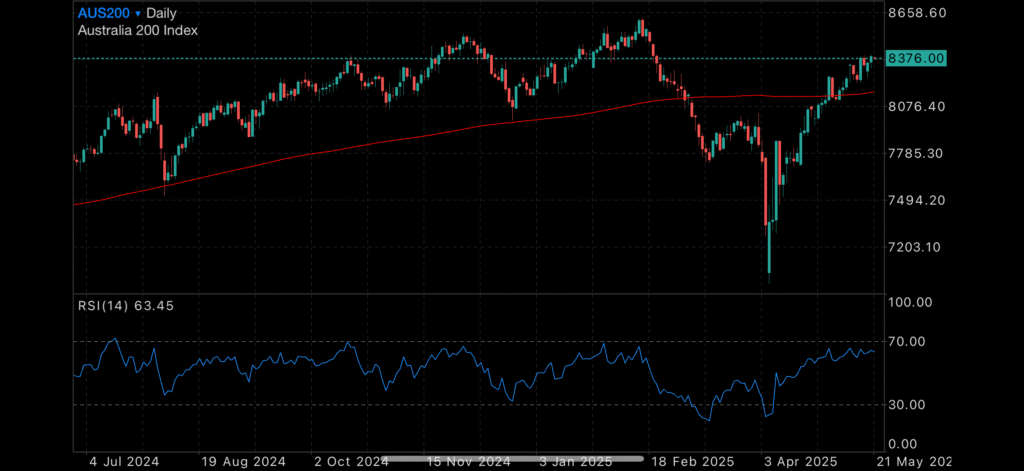

ASX200, with 200MDA