Inflation data floors the Dow 500 points

Gold Spot Price $AU3090

Silver Spot Price $AU34.39

Platinum Spot Price $AU1369

Markets reeled yesterday, with a sea of red flowing throughout the Dow (-1.35%), Nasdaq (-1.8%) and also the SP500 (-1.37%).

The markets’ response came from a hotter than expected CPI print for January.

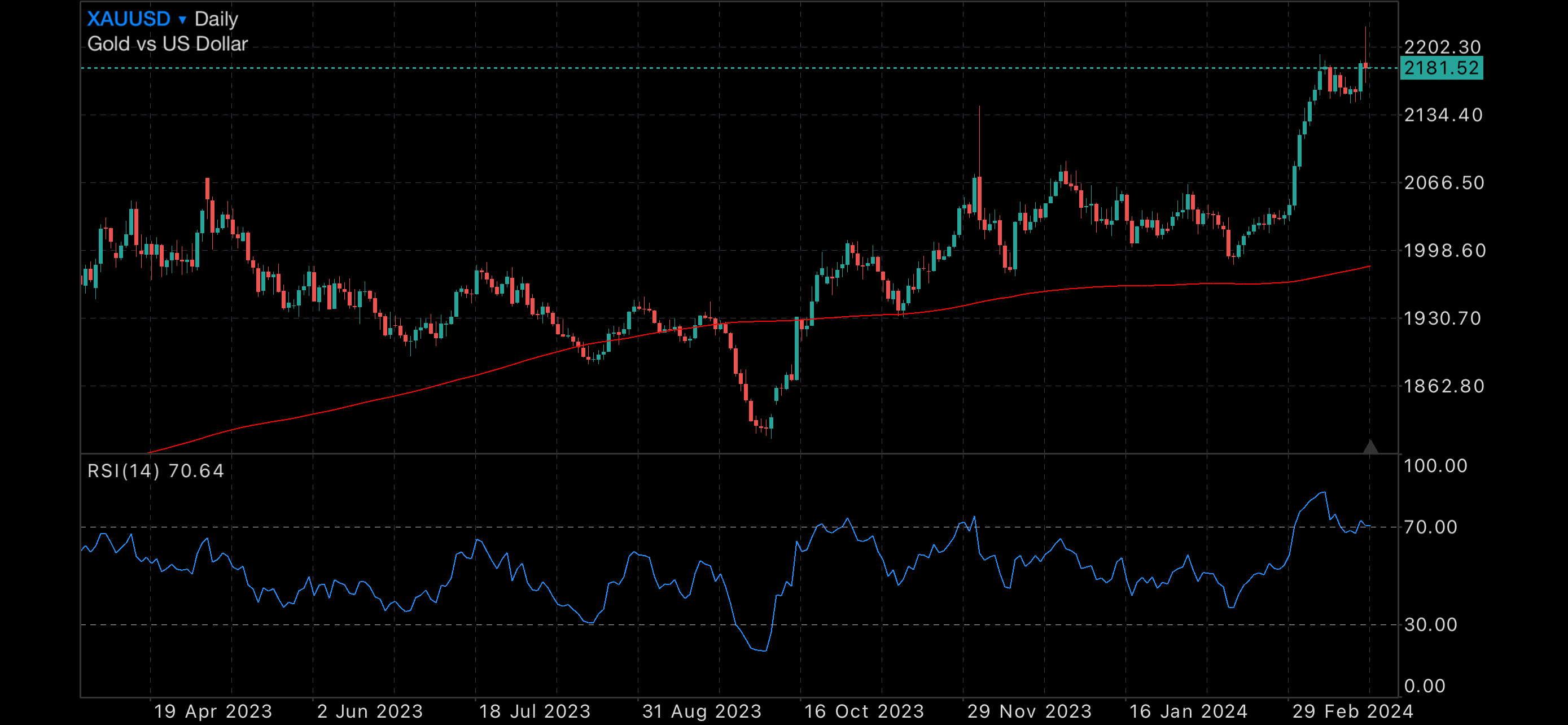

Gold pricing also dropped overnight, slipping aggressively from $US2030 down to $US1992 at the time of writing. While Gold has immediately reacted like the rest of the market to this poor CPI news, we could well see a quick rebound as investors move away from risk on assets, to defensive positions in the coming week.

And with such a strong reaction from the market, you would think that the CPI print was ‘shocking’. The FED anticipated CPI for January to report at 0.2%. It came in at 0.3%.

For such a drastic result on the back of a small CPI print difference – we’re hitting a very volatile part of the market timeline. As investors are throwing everything (and highly leveraged) at the stock market as they anticipate rate cuts, it only takes small reporting differences like yesterday’s CPI print to cause absolute havoc.

And of even more importance, the FED just hinted that they still may need to increase rates yet again to keep inflation under control. This is a far cry from the promises made just prior to Christmas of rate cuts early this year. With annualised inflation averaging around 3%, the FED has some ways to go to achieve its magical 2% print before proceeding with any monetary policy easing.

Enjoy today’s charts.

Gold daily, with 200MDA

Silver daily, with 200MDA

US500, with 200MDA

ASX200, with 200MDA