Debt Surge, Inflation Pressures, and Gold’s Relentless Run

Monthly US consumer credit surged in the latest release, rising $16 billion compared with estimates of $10 billion. The stronger-than-expected figure highlights the growing reliance on debt as households grapple with higher living costs, a trend that may prove difficult to sustain if economic conditions soften.

Meanwhile, US inflation continues to linger uncomfortably close to the upper edge of the Fed’s target range. The CPI came in at 2.9%, raising questions about whether the central bank can keep to its path of rate cuts. While markets have been banking on further easing, the data suggests inflationary pressures are still alive, leaving policymakers with little room for error.

Gold, however, remains the standout story. Prices are now consolidating around US$3,600, having climbed to yet another record high. Investors are split on whether this is simply a pause before the next leg higher, or the first signs of fatigue after an extraordinary winning streak. With debt growth flashing warning signals and inflation refusing to roll over, safe-haven demand for gold may still have room to grow.

Our news team is taking a brief rest over the next period. We’ll reach out soon with more summaries around economic activity and bullion pricing in the near future. Enjoy the weekend, remember to do your own research before investing.

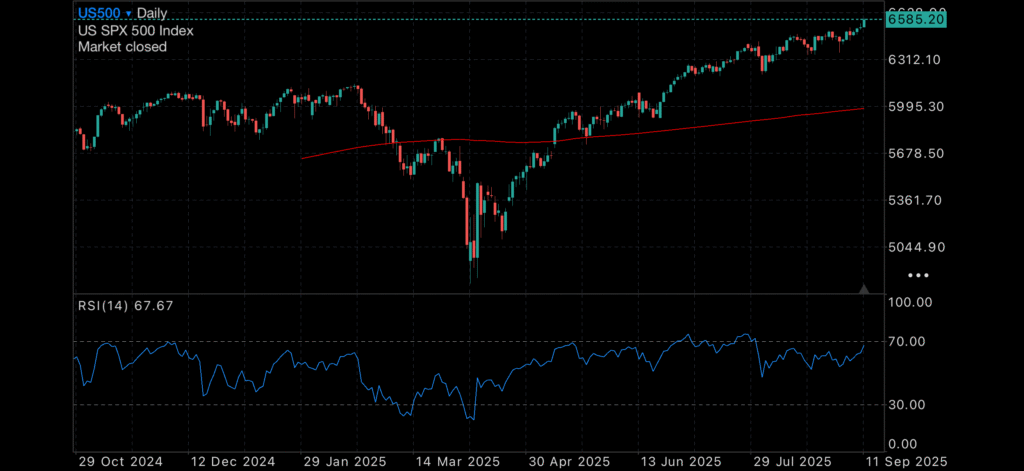

Market Snapshot

- Gold – $AU5457

- Silver – $AU62.51

- US500 – 6585

- ASX200 – 8849

- AUD/USD – 0.6657

Gold Futures Technical Analysis

Technical indicators for Gold Futures suggest a STRONG BUY on both monthly and weekly analyses.

Technical Indicators – Monthly Projections

| RSI(14) | Overbought |

| STOCH(9,6) | Buy |

| STOCHRSI(14) | Overbought |

| MACD(12,26) | Buy |

| ADX(14) | Overbought |

| Williams %R | Overbought |

| CCI(14) | Buy |

| ATR(14) | High Volatility |

| Highs/Lows(14) | Buy |

| Ultimate Oscillator | Buy |

| ROC | Buy |

| Bull/Bear Power(13) | Buy |

Summary for Monthly Forecast: Strong Buy

Charts today

Gold Daily, with 50MDA

Silver Daily, with 50MDA

US500 Daily, with 50MDA

ASX200 Daily, with 50MDA