Silver has experienced a remarkable resurgence this year, quietly climbing alongside gold’s headline grabbing performance. PAMP Suisse silver products stand as the premium choice for Australian investors seeking uncompromising quality and authenticity in today’s volatile precious metals market.

PAMP Suisse, headquartered in Ticino, Switzerland, has been the gold standard of precious metals refinement since 1977. That is because analysts now believe the market’s perception of silver, or the group of people buying and selling it, is fundamentally changing – with quality and provenance becoming increasingly important factors for discerning buyers.

Jaggards proudly offers an extensive selection of PAMP Suisse silver coins and rounds, each representing Swiss excellence in purity and craftsmanship. These aren’t merely silver products – they’re investments backed by one of the most respected names in precious metals.

As an authorised dealer of PAMP Suisse products, Jaggards provides Australian investors with direct access to these premium silver coins and rounds. Our relationship with PAMP ensures authenticity and competitive pricing for our customers.

While exchange-traded funds (ETFs) have significantly pushed demand for precious metals, many sophisticated investors prefer the tangibility and privacy offered by physical silver from respected refiners like PAMP Suisse.

FAQs

Silver has performed remarkably well against gold in 2025, with some analysts noting its percentage gains have outpaced the yellow metal during certain periods. While gold remains the premier precious metal for wealth preservation, silver’s dual role as both an investment asset and industrial commodity gives it unique market dynamics. The industrial demand – driven by electronics, solar panels, and medical applications – provides a foundation of utility that gold lacks. Despite silver’s abrupt price fluctuations, its lower entry point makes it accessible to a broader range of investors. The gold-to-silver ratio, a metric watched by serious precious metals investors, has compressed in recent months, suggesting silver may have further room to run in this market cycle.

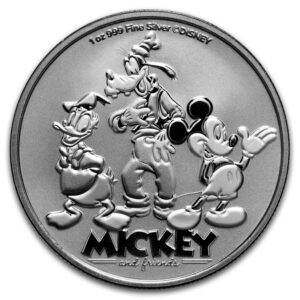

The primary difference lies in legal tender status. Silver coins are official currency issued by government mints with a face value, making them legal tender backed by the issuing government. Silver rounds, while similar in appearance, are produced by private mints and carry no denomination or legal tender status. This distinction affects several aspects: coins typically command higher premiums due to government backing and guaranteed authenticity; coins often feature advanced security features like microminting; and coins may have additional value beyond their silver content due to collectability or numismatic appeal. Both contain the same silver purity when marked 999 or 9999, but the government guarantee behind coins provides additional confidence for many investors.

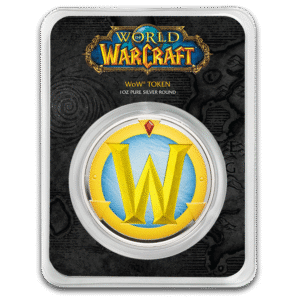

A Licensed Coin represents a specialised category in the precious metals market where officially authorised designs from popular brands, entertainment franchises, or cultural properties are minted on legal tender coins. Unlike standard government-issued coins, these products feature designs from Disney characters, superhero franchises, or other intellectual properties through formal licensing agreements with the copyright holders. The licensing ensures authenticity and legal reproduction of these protected images on investment-grade precious metals. These coins typically command higher premiums due to their dual appeal – combining the intrinsic value of their precious metal content with the collectible appeal of beloved characters or brands. Licensed coins often have strictly limited mintages, enhanced by colorisation techniques, and come with official certificates of authenticity, making them attractive to both precious metal investors and franchise enthusiasts.